“The technology most likely to change the next decade of business is not the social web, big data, the cloud, robotics, or even artificial intelligence. It’s the blockchain, the technology behind digital currencies like Bitcoin.”

– Harvard Business Review 2016

“Virgin Galactic is a bold entrepreneurial technology. It’s driving a revolution and Bitcoin is doing just the same when it comes to

inventing a new currency.”

– Sir Richard Branson

What is blockchain?

Here’s one definition: “Blockchain is a shared, distributed ledger that facilitates the process of recording transactions and tracking assets in a business network. An asset can be tangible – a house, a car, cash, land – or intangible, like intellectual property such as patents, copyrights, or branding. Virtually anything of value can be tracked and traded on a blockchain network, reducing risk and cutting costs for all involved.” Blockchain for Dummies

Here’s another: “The blockchain is a public ledger where transactions are recorded and confirmed anonymously. It’s a record of events that is shared between many parties. More importantly, once information is entered, it cannot be altered.” WTF is the Blockchain?

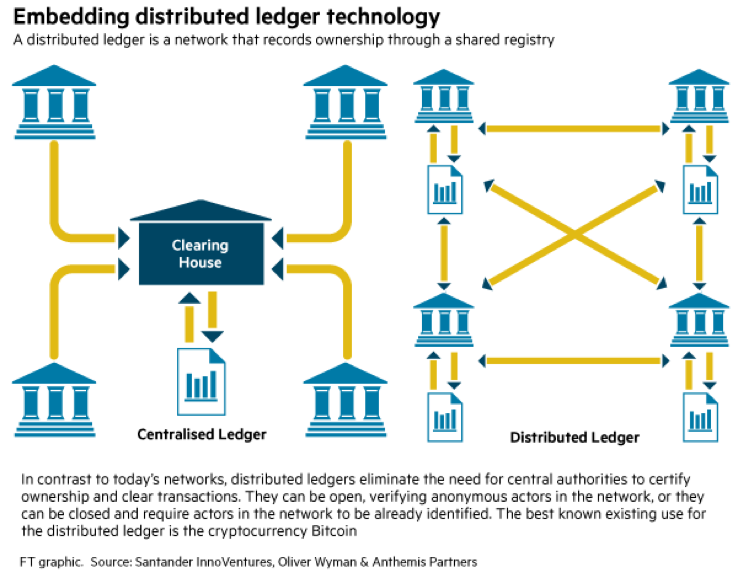

In short, blockchain is a decentralized ledger. Let’s start with the opposite of a decentralized ledger – the centralized ledger. Examples would be bank statements, credit card bills, or local tax bills. The ledger is where transactions are recorded. By transactions, we mean transfers or exchanges of assets into or out of a particular account.

If we are using a centralized ledger, the transaction is compiled and authenticated by a central agent. In the case of a financial transaction, that central agent is the bank. The bank verifies the transaction. If the transaction is a transfer of funds, that transfer is deemed to have been made even if one of the parties to the transaction disagrees.

The bank as the central authority has full control over the ledger. That is the one major distinction between a decentralized ledger like blockchain and a centralized ledger. A centralized ledger system requires a trusted central agent, like the bank or a government agency, to accurately compile and authenticate transactions. It can’t function without one.

In contrast, a blockchain is a decentralized ledger. It is a ledger synchronized across a peer-to-peer network of computers. This ledger permanently records changes to the database, such as transfers in and out of an account, using very sophisticated encryption algorithms. These algorithms take data and run that data through an algorithm that results in an output of a set length.

Because of how these algorithms function, it is extremely difficult to start with the output and reverse the process to arrive at the input data. The only method is brute force, which means feeding in combinations of data and comparing them to the hash output, a very lengthy process that requires significant computing power.[1] Even a small change in the input data will result in a large change in the algorithm’s output.[2]

Blockchain’s innovation on the encryption process is that each block of a blockchain contains not only the pointer to the next block in the blockchain, but an algorithmic encryption of all of the data inside each previous block. Thus, if a hacker wanted to make even a small change in the data stored in a blockchain, that would cause the algorithm to alter, and the chain would immediately reject it because it would not match. This makes the blockchain immutable.[3]

The graphic below shows the key differences between a centralized versus a decentralized ledger.

But how is a transaction verified on the blockchain? It is verified through a process known as consensus. When there is consensus on a blockchain, a new block is added to the ledger, forming a sequential chain of transactions; hence, the name blockchain.

Each block contains an encrypted version of the data from the previous block, so each transaction can be validated by all computers on the network.[4] Because no one party controls the data or the information, every party on the network can verify the records on the ledger directly, without reliance on a central authority. The result is greater efficiency, less cost, greater speed, more transparency and more robust security than is typically found in centralized, and trust-based systems.[5]

Blockchains and Cryptocurrencies

Is the blockchain the same as a cryptocurrency?

No, blockchain is the enabling technology behind cryptocurrencies, of which Bitcoin is the most famous, but they are not the same. A cryptocurrency is a digital or virtual currency designed to work as a medium of exchange. It uses cryptography to secure and verify transactions as well as to control the creation of new units of a particular cryptocurrency. Cryptocurrencies make use of all the advantages of distributed ledger technology as implemented by a blockchain.

One of the most important problems that any payment network has to solve is double-spending, which is a fraudulent technique to spend the same money twice. Double-spending is traditionally avoided by using a central agent, who keeps and authenticates transactions. Central agents, however, charge fees and they also maintain personal details of the parties and the individual transactions.

In 2009, an anonymous programmer (or a group of programmers) under the alias Satoshi Nakamoto introduced the seminal whitepaper, “Bitcoin: A Peer to Peer Electronic Cash System.” The Satoshi Nakamoto paper ignited a firestorm that has evolved into today’s cryptocurrency industry.

Satoshi Nakamoto’s system is completely decentralized, meaning there are no centralized servers involved and no central agent. It’s peer-to-peer. In the Bitcoin decentralized network, the participants fulfill the functions otherwise handled by a central agent, such as authenticating transactions.

In a cryptocurrency-based system, anyone with a digital currency wallet can transfer Bitcoin or another virtual currency from anywhere to anyone who also has a digital currency wallet using a smartphone app. For example, a Bitcoin can be sent directly to the intended recipient’s wallet, pseudonymously (if the sender wishes) and with minimal transaction fees, with the amount and addresses recorded on a public ledger, each of which adds a block to the chain.

While blockchain transactions are not instantaneous, they are much faster than standard banking transactions, taking several minutes rather than several days. Moreover, every transaction on the blockchain is visible to anyone in the computer system. Each user (known as a node) on the blockchain has a unique alphanumeric address, and everyone on the network can monitor each transaction.

Because the ledger is chronologically ordered and stored on many computers across the network, it is, by design, more secure. A “hack” of a distributed ledger would require simultaneous changes to data on all systems, which is very difficult to do. The algorithm behind the blockchain has (thus far) been reasonably secure.[6]

“I’m reasonably confident … that the blockchain will change a great deal of financial practice and exchange … 40 years from now, blockchain and all that followed from it will figure more prominently in that

story [of the future of finance] than will bitcoin.”

– Larry Summers, US Former US Treasury Secretary – Consensus 2016, New York City

With new technologies, terms are created quickly and used interchangeably even when there may not be clear agreement as to the meaning of such terms. Two terms used just this way to describe units of blockchain value are coin and token. In its strictest sense, a coin is a medium or exchange or a means of payment.

Crypto-coins tend to be native blockchain coins like Bitcoin, Ether, Litecoin, or Monero. Tokens, on the other hand, generally offer functionality over and above just a means of payment. Tokens can represent votes by the community regarding key platform business decisions, or they can represent hard assets or the right to an asset like an intellectual property license. They can even be technological evolutions to a platform.[7] We are just starting to explore the myriad uses of tokenization in business. Every indication is that token use will continue to grow, perhaps exponentially.

“Tokens are particularized digital assets, each immutably tied to a specific cryptographic key. It is not financial sophistication that is needed to understand these assets but rather technological sophistication and, if I may say, a healthy amount of imagination as to what the future will look like and the types of products and services that will be appealing to people.”[8]

So why the excitement?

Lewis Cohen, one of the country’s leading cryptotechnology attorneys, made the following prescient observation in his Medium article entitled, “A Crypto-Capital Markets Lawyer Looks Back on 2007”: “In 2017, legacy participants in the capital markets woke up to the opportunities (and threats) that blockchain technology and tokenization could pose to the way in which funds are raised and capital is accumulated for investment. With the equivalent of about U.S. $5 billion in funds raised in 2017 through the sale of digital tokens according to some estimates, it was hard for mainstream, legacy participants not to take notice.”[9]

Mr. Cohen’s article provided an interesting capital markets perspective on blockchain technology and tokenization, but it’s not the only perspective.

On August 8, 2016, Union Square Ventures published an article entitled, “Fat Protocols,” discussing blockchain value from the perspective of network protocols. The Fat Protocols article suggested that the seminal difference between the internet and blockchain was the use of network protocols.

In short, the previous generation of internet shared protocols became commoditized over time. The value of the internet was captured at the applications layer by the likes of Microsoft, Google, Facebook and others. As a result, the Internet stack itself is comprised of thin protocols (e.g., TCP/IP, HTTP, SMTP) with fat applications layered on top. The market rewarded investments in these fat applications, but not in the internet protocol layer, which generally produced astronomically low returns.

The Fat Protocols article suggests that it’s entirely the other way around in the blockchain world. As a result of blockchain architecture, value is at the shared protocol layer with only a fraction of that value being distributed at the applications layer. It’s a stack with fat protocols and thin applications.

This is a significant point according to the Fat Protocols article. Unlike in the internet world, in the blockchain world the market cap of the network protocol will always grow faster than the value of the applications built on that protocol.

The very success of the application layer will drive further speculation at the protocol layer creating a virtuous cycle – successful application drive platform adoption and vice versa. This dynamic is very much in play in the two dominant blockchain networks, Bitcoin and Ethereum. The Bitcoin network has a $145B market cap (as of March 19, 2018), yet the largest companies built on top of Bitcoin are only worth a fraction of that. Similarly, Ethereum has a whopping $53B market cap.

It remains to be seen whether the Fat Protocols thesis is accurate. In today’s world, which is still predominantly software- and cloud-based, it’s hard to imagine a technological scenario where applications are not of much value.

Over the next decade or two, thousands of companies will offer new and innovative network protocols the likes of which we can’t even imagine today. Telegram is one such example. Telegram’s ICO for its cryptocurrency, the Telegram Open Network (TON), is raising over USD$2B.

Telegram is an encrypted chat platform with 200 million users. Telegram is the platform of choice for people involved with cryptocurrencies who will use it to launch project token sales and ICOs, keep followers up to date on projects, and coordinate developer efforts.

The Telegram tokens will be closely integrated with its chat application and will provide solutions for file storage, payments, and anonymous browsing. Their goal is to create a solution for cryptocurrency payments.[10]

In addition, in Kodak’s 2017 10-K published on March 15, 2018, it announced the KODAKOne platform, which is a blockchain-based technology for creating an encrypted, digital ledger of photographic rights.

With KODAKCoin, participating photographers are invited to join a new economy for photography, receive payment by KODAKCoin for licensing their work, and for both professional and amateur photographers, sell their work on a secure blockchain platform.

“For many in the tech industry, ‘blockchain’ and ‘cryptocurrency’ are hot buzzwords, but for photographers who’ve long struggled to assert control over their work and how it’s used, these buzzwords are the keys to solving what felt like an unsolvable problem,” said Kodak CEO Jeff Clarke. “Kodak has always sought to democratize photography and make licensing fair to artists. These (blockchain) technologies give the photography community an innovative and easy way to do just that.”[11] Kodak was paid USD$750K in cash by WENN Digital, the company developing KODAKCoin and the related digital rights management platform.

Applications of blockchain technology will leverage this innovative technology in different ways to provide a diverse range of benefits across many sectors. Goldman Sachs has already identified five potential real-world use cases for the technology from AirBnB through to Property Sales and Finance.[12] Investment in blockchain-related projects has surpassed USD$1.1 billion, with many emerging companies in the Puget Sound Area at the forefront of this technology (with real world applications) driving the technology forwards. Goldman Sachs and Google are two of the most active investors in blockchain firms.[13]

The Harvard Business Review of 2016 concluded that there was strong evidence that the blockchain could transform business, government and society in a more profound way than simply transforming the financial sector. The impact of the blockchain could be so profound that it will rival or even surpass that of the internet itself.[14] Predictions of the imminent transformation of traditional industries on account of blockchain, however, are greatly exaggerated. That said, disruption is on the horizon. An article on the Investcryptocurrency.info website lists 19 industries that will be disrupted by blockchain.[15]

Conclusion

Despite the plethora of oracles in this field, it’s very hard to predict where blockchain and cryptotechnologies will head. What we do know is that both startup and mature, established companies will continue to explore how blockchain can be deployed to make all aspects of their business more efficient.

Business problems that can be solved using a decentralized ledger with all the rich features of blockchain, such as immutability, security, and transparency will be the first to deploy this technology and we are seeing examples of that daily.

The use of cryptocoins and tokenization will continue to grow as well, particularly in token use cases where there is value in a “network effect.” This is not always the case, however. There are many technology solutions that operate fine without tokenization. Not every technological solution needs a network effect to be successful.

[Editor’s note – for additional reading check out What is the Blockchain (The Plain English Version)]

Disclaimer

This article reflects the personal views of the author in his individual capacity. It does not necessarily represent the views of Summit Law Group, PLLC or its clients, and is not sponsored or endorsed by them. The purpose of this article is to assist in the dissemination of general information for educational purposes only on topics that may be helpful to its readers, but no representation is made as to the accuracy or timeliness of the information. By reading this article, you understand that the information herein is not provided in the course of an attorney-client relationship and is not intended to constitute legal advice. This information should not be used as a substitute for competent legal advice from a licensed attorney in your state. This article is not intended to be advertising and its author does not wish to represent anyone desiring representation based upon viewing this article.

[1] The average number of attempts to arrive at the hash is 1.7X10^138 for 128-bit hash.

[2] Example of 256 Hash

| I own $1,000,000 USD | 5C90245D176F4E75C0AC90C42C618BA2E7445A752456D7A336DB16554F162D58 |

| I own $1,000,000 US | 128201E945961A4CF504C482DA46D4B841513212A7C0C5799075E0DC2E999AAD |

[3] Within the blockchain community, the statement “code is law” equates to immutability.

[4] For a new block to be added, blockchain software usually requires a mining node to find a needed hash to produce a specific number, which in Bitcoin is done via brute force. As noted, this requires substantial energy and computing power. Other blockchains are improving the method of consensus to require less energy. Mining nodes are rewarded for their work in coins of the blockchain. Bitcoin typically requires 10 minutes for a new block to be added, and the award is around 12 bitcoins. The coins are the incentive to perform the proof of work.

[5] From “An Introduction to Blockchain Technology,” by Laura E. Jehl (Baker & Hostetler LLP).

[6] From “An Introduction to Blockchain Technology,” by Laura E. Jehl (Baker & Hostetler LLP). While there have been highly-publicized thefts of digital currency, those incidents involved the compromise of internet-connected digital currency organizations or exchanges, not of the blockchain itself.

[7] https://blog.chronobank.io/token-vs-coin-whats-the-difference-5ef7580d1199

[8] Lewis Cohen, “A Crypto-Capital Markets Lawyer Looks Back on 2017” – https://medium.com/@nycryptolawyer/d5eb2123e570.

[9] Lewis Cohen, “A Crypto-Capital Markets Lawyer Looks Back on 2017” – https://medium.com/@nycryptolawyer/d5eb2123e570.

[10] https://hackernoon.com/an-overview-of-the-telegram-ico-e42434f722b1.

[11] https://www.kodak.com/corp/press_center/kodak_and_wenn_digital_partner_to_launch_major_blockchain_initiative_and_cryptocurrency/default.htm.

[12] https://finance.yahoo.com/news/goldman-sachs-identifies-5-big-ways-blockchain-tech-can-change-the-world-153801655.html.

[13] https://www.cnbc.com/2017/10/18/google-goldman-sachs-investors-blockchain.html.

[14] https://hbr.org/2016/05/the-impact-of-the-blockchain-goes-beyond-financial-services.

[15] http://www.investcryptocurrency.info/19-industries-blockchain-will-disrupt/.